3 photos showing huge effects of TRAIN (new tax law)

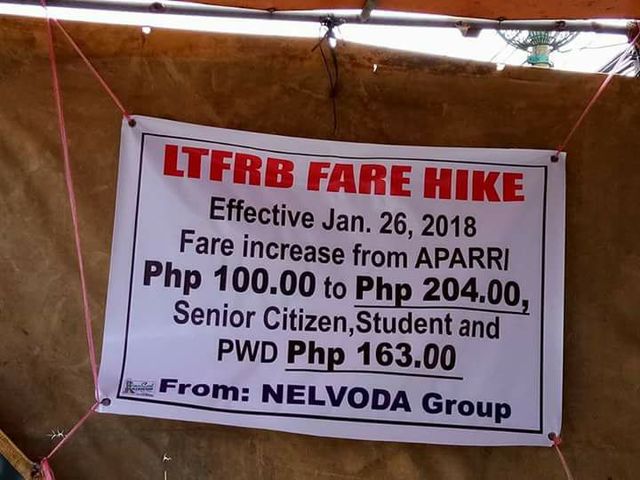

Rappler reports, "Public utility vans (PUVs) have begun charging higher fares in Cagayan Valley after the Land Transportation Regulatory and Franchising Board (LTFRB) approved the new fares. The LTFRB said in a certification issued on Wednesday, January 24, that the approved fare from Tuguegarao City to Claveria is P360 for regular commuters and P288 for students and senior citizens – from the previous fare of P216. A poster at the Aparri van terminal notified commuters that starting Friday, January 26, van operators would charge them P204, or more than double the current fare of P100, for the Tuguegarao City to Aparri route." (Raymon Dullana Published 10:25 PM, January 27, 2018 Updated 10:26 PM, January 27, 2018)

For its part, IBON Foundation, a non-profit development organization, pointed out that the TRAIN law would be a big blow to the country’s poorest, arguing that poor families will bear the brunt of higher prices on basic goods and services without getting any income tax exemptions. IBON also stressed that the country's rich would be the "biggest gainers" from the TRAIN act "especially when income taxes are lowered further in 2023." “Most of the country’s total 22.7 million families do not pay income tax because they are just minimum wage earners or otherwise in informal work with low and erratic incomes,” IBON said. “Even if TRAIN reduces income taxes paid by most of the reported 7.5 million personal income taxpayers, this still leaves as much as 15.2 million families without any income tax gains,” it added. (Winners and losers: How the TRAIN law affects rich, poor Filipinos; By Ian Nicolas Cigaral (philstar.com) | Updated December 23, 2017 - 12:18pm)